link: Modern Money Mechanics

Modern money mechanics is a workbook that explains how the US Federal Reserve creates/contracts the money supply. It goes through the details of fractional reserve banking. Many balance sheet examples are used to show what’s going on. I found this document through the youtube channel @EPBResearch that does excellent macro-economic analysis of the US economy. The workbook is short with only 40 pages, but it takes a few reads to get a good grasp of the material.

You might hear the phrase “the government prints money”. Yes, money is created, yes there is a printer printing money, but the process is not so straightforward. This workbook will show you how it happens from an accountant’s perspective.

Comment 1

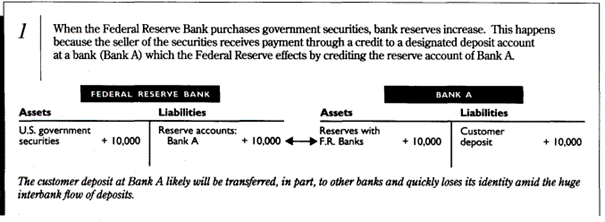

I find the first example a bit confusing because, in my opinion, many middle steps are skipped, and a lot of notions are assumed and not shown. The example shows how the Federal reserve creates money by buying government securities from a seller. Excerpt:

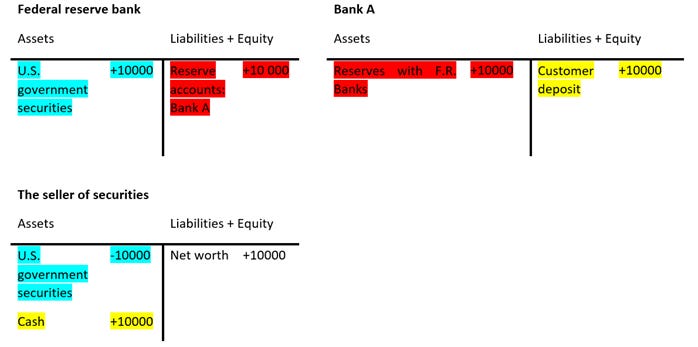

A more pedagogical way of doing this example would be to include a third account balance belonging to the seller of the securities. Also, the liabilities side of the account is understood to mean liabilities + equity. Equity being your wealth or net worth (assets-liabilities=equity). This is the common way of writing T-accounts, and accountants know this. But if you’re learning on your own, it’s confusing. Including middle steps and extra seller’s account, this is what it would look like:

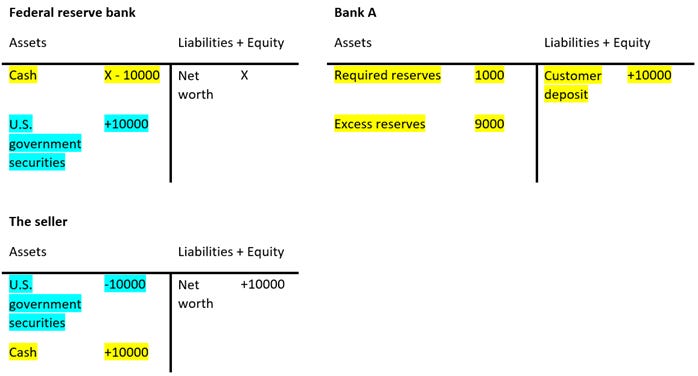

Now even with all the middle steps and extra accounts, the transaction still looks weird because the customer deposit on Bank A assets appears as “Reserves with F.R. Banks” and not just as normal Bank reserves. As written, the transaction looks like the Fed is paying Bank A with a credit so that Bank A can give its own cash to the seller. My intuition would be to see the whole transaction like this:

The “x” on the Fed’s balance sheet can be any number it wants. If it wants to buy 100 000$ of securities, it can just do x=+100 000$ and buy them. But then maybe it looks too obvious that the Federal reserve is creating money out of thin air. Giving a credit to bank A, like in the book, looks nicer.

Money creation doesn’t end here. In the example, bank A has a deposit of 10 000$. It will then loan out 90% of that deposit to bank B and keep 10% as “Required reserves” by law. Bank B will do the same. Loaning 90% of its customer deposits and keep 10% as Required reserves and so on. This is the money multiplier effect. By buying 10 000$ of securities the Fed has added 100 000$ to the money supply. The formula is (value of securities bought)/(% required reserves)=(money created). The same works in reverse when the Fed sells securities. This is the essence of fractional reserve banking which the workbook covers quite well with balance sheet examples. And this is how the federal reserve creates money. If your country has a central bank, then it works the same way.

Comment 2

It’s implied in the workbook that inflation isn’t a bug of the economy, but a feature. The quote is on page 3: “What makes money valuable?”

The author says, the money supply must keep up with GDP or else there will be deflation. It’s not explained why deflation would be a bad thing in the book. Maybe it is, I haven’ looked into it. Running the thought experiment of an economy with a constant money supply leads to weird scenarios. Suppose a country with a fixed money supply. People continue innovating and producing more each year. Every year there is more stuff but less money to buy stuff. The value of money goes up or the price of stuff goes down depending on how you want to look at it. If you own a company that makes spoons, then every year you are selling your spoons for less. Are you losing money? Not really because the same is happening to your raw materials. What about labor? If you keep your employees pay constant, they’re effectively getting an pay increase every year equal to deflation. What about fixed costs? If your bank charged 0 interest, it would be like paying interest equal to deflation. So maybe they would charge a little bit more.